A debt, financial burden becomes what should not refund necessarily anymore. There are several Internet blogs and lawyers educating people about how to avoid debts. From the perspective of moral principles, this phenomenon is controversial. Nevertheless, people who are in debt are taking an interest in those methods. To escape from the vicious circle of a debt, insolvent debtors have no choice. No matter why people have become debtors, most of them failed to manage their credit.

To be specific, managing one’s credit means managing one’s credit rating. In the financial sector, credit rating exists for each single person. This rule is generally applied when banks do background checks on individuals for a loan, but the current credit rating system has some problems.

In addition to the criteria problems, there are other problems to solve. When financial facilities estimate a consumer’s credit rating, they generally make use of poor information. For example, they look at only loan or sums unpaid data. A better use of information would be to look at deposit or credit card use, which is not utilized.

Managing credit ratings is not only important to people on the job but also important to university students. Actually, a student can be rejected for a school loan when his or her credit rating is low. Until last year, students whose credit rating was only 10 were rejected for school loans. However, from this year, credit ratings of 9 or 10 cannot get a loan.

The credit crisis for young people is in a severe condition. Then, what can university students do to manage their credit? Rather than using a credit card, it is better to use a debit card. Using a credit card at an early age can make university students develop a bad habit: overconsumption. On the other hand, a debit card is utilized with limitations (i.e. - the limit of their bank balance). So using this card can prevent overconsumption and payment arrears. In addition, a debit card can be issued without a credit inquiry, so applying for a debit card has no influence on a student consumer’s credit rating. In contrast to the debit card, a credit card can be dangerous. For example, if a card user falls into arrears only one day, their credit rating falls.

Opening an account with a certain bank is also a good idea to manage credit easily. Rather than opening an account with many banking facilities, choosing one bank to do business is safer, and it makes it easier to obtain a higher credit rating.

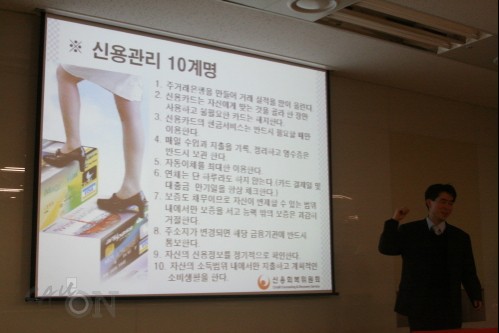

As stated above, university students and young people need knowledge about methods to better manage their credit. To examine more information about credit management, the Chung-Ang Herald (CAH) attended a lecture at the Seoul Integrated Job Center. A lecture is held there once a month, the second Thursday each month. This center was an affiliated organization to the Ministry of Labor, and the lecturer belonged to the Credit Counseling and Recovery Service. The main content of this lecture is how to manage credit. The information below illustrates some observations that CAH would like to note.

-Resolve any of your credit restrictions

-Do not acquire unnecessary credit. (Especially when you are under a low credit condition), because financial facilities doubt your trustworthiness or that you may flee or disappear.

-If you are in debt (with more than two loans), pay off the former loan first. Financial institutions attach more importance to period or timeliness of payments rather than its scale.

-If your address changes, it is wise to inform financial institutions as soon as possible. You may get a disadvantage on your credit rating for not changing the address.

-Keep in mind that managing credit is an important key in financial security.

-Credit Counseling and Recovery Service-

This organization helps people who have failed to pay their financial debts. It councils them about debt readjustment programs according to the debtors’ repayment abilities. In addition, the organization recommends jobs to debtors who are unable to apply for credit recovery support due to low income. Obviously, this is a nonprofit organization, which performs lectures (An Importance of Managing Credit) for students and adults.

As mentioned above, the Credit Counseling and Recovery Service helps debtors, who are suffering from debt. Then how can a State organization help individuals get financial relief?

Here are some examples of how the court of justice performs.

.

-Individual revival system-

Court of justice readjusts debtor’s debts by compulsion. (Especially to debtor who are confronted to bankruptcy)

-Individual bankruptcy system-

According to a debtor’s request, court of justice adjudicate a person to bankruptcy. (A debtor is incapable of refunding)

-Loan system to collect former debt-

People who have low credit or are in arrears can refinance their loan or loans from financial facilities and refund sums still unpaid. Some credit card corporations can change a customer’s unpaid debt into long-term loans to lower the consumer’s interest rates.

By misusing these systems, immoral debtors attempt not to repay their debts. To prevent such misuse, a debtor’s minimum effort to repay their debts should be proven institutionally. In addition to institutional supplements, people’s morality is also necessary.

To raise people’s awareness as related to credit management, a systemic credit education program is inevitable. However, Korea is still deficient in such education. But there are some efforts being made to enlighten students and the public. Sungkyunkwan University has executed a credit education program with Samsung card. Seoul YMCA has sponsored UCC (User Created Contents) contests, which aimed to educate adolescences and university students about managing credit cards.

At the present, people seem to be living in equality. It is not a hierarchical social structure. How would you feel if your rating was rated without any notice? Financial institutions already ranked your credit rating and have constantly managed it. Once your credit rating drops, it is hard to recover a previous higher rating. To avoid belated regrets or unnecessary damages, students should be concerned about their credit management before individual bankruptcy becomes their story.