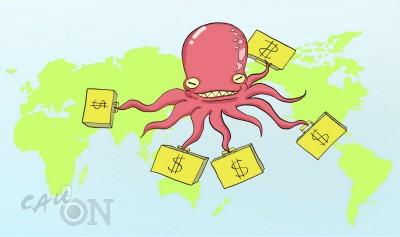

However, this idea is only an assumption. While competition among many nations of the world in attracting foreign investment is keen, it has also bought an inflow of foreign capital into the country. According to this situation, the security and economy of a country can become vulnerable in the hands of foreigners.

In Korea, hostile M&A (Mergers and Acquisitions) and their risks have been exposed in the news lately. For example, the attack of Sovereign Asset Management against Korea’s SK Corp., or the threat to KT&G because of Carl Icahn who is a famous raider. However, the legal means and defense about management’s right to govern the company is not always ensured. So the many industries can become exposed and defenseless to foreign speculators.

Therefore, many countries are deciding to regulate to protect their nationally important industries from hostile M&As.

<No, until security!>

The U.S Congress passed the “Exon - Florio law” in 1988. When a foreign company takes over an American company, there must be a judgment on whether there are any threatening factors to national security. If there is a problem, the Congress can disapprove the take over. Therefore, in conformity with the law, if a foreigner buys an American company, they must first get approval from CFIUS (Committee on Foreign Investment in the U.S).

When the law became effective, ‘Fujitsu’, which was trying to take over American semiconductor company ‘Fairchild’, was frustrated. Under the new law and certain circumstances, companies must put a brake on sales, until the issue of management and ownership are completed. There have been about 10 cases in which this has happened.

One example is IBM-Lenovo. The Lenovo Company, which is a Chinese maximum personal computer manufacturer, contracted to take over a PC business section of IBM for about 12 billion dollars in 2005. However, it was debated the contract could harm national security. If a computer design and facilities of IBM, which is located in North Carolina, fell into Chinese intelligence through leaks at the Lenovo Company, a problem could develop between the two nations.

However, the problem is that the United States did not state concrete guidelines, thus the law is vague. “It is subjective to define what kind of industry is by industry about national security. Finally, according to this subjective judgment, this law can result in side affects.” said Professor Lee Doo-won at the School of Economics Yonsei University.

However, the Exon - Florio law regulation works as an obstacle to foreign direct investment. In other words, what strengthens M&A laws for national security runs counter to the potentially large stream of foreign investment and an open economy.

Therefore, the Europe Union resists this law of protectionism, because the EU is sensitive to economic problems. “The EU is worried that this law is excessively subjective and arbitrary. Therefore, it spends too much. However, the United States does not use this law, and applies sanctions about M&A tries from countries in the EU. However, when Chinese or Arab companies try to take over American industry, the United States mentions this law. Yet, nations having country armament agreements or similar industrial production with the EU, they agree to M&A tries though they should be repelled in this law,” said Professor Lee.

Nevertheless, the United States regulates hostile M&A mergers of foreign capital for domestic companies with this law, when the U.S.A negotiates for FTA (Free Trade Agreement) with another country; they want they abolish these types of laws. It is antinomy. As previously stated, interpretation differs about how much range to apply this law. It is important to how company operations work.

If the Exon - Florio was national, there is ‘Poison Pill’ at company dimensions.

<Pay more money!>

In the beginning of the 1980’s, large scaled M&A was achieved in the U.S.A. As businesses began to financial fall off, and the number of ailing companies increased, M&A companies started buying companies and liquidating the assets that had been taken over. This provided hard cash for the M&A company. Therefore, many companies were busy to take defensible measures. At that point in time, Martin Lipton, lawyer of a law firm that specializes in M&A, had an idea. When a company is threatened with a hostile M&A, the existing stockholders can buy large-scale new issued stock at half the price. In this way, the 'Poison Pill clause' came into being.

GM (General Motors), an international automobile company, suggested the ‘Poison pill’ clause, when they advanced into Russia in 2001. GM bought into a large-scale joint investment with AvtoVaz, a Russian automobile company, this was strategically meaningful. Meanwhile, GM endeavored to move into the Russian market. The joint venture was achieved with AvtoVaz, but if AvtoVaz gets into a situation, where another company tries to take over, the AvtoVaz management has the opportunity to raise capital through their GM investor.

The ‘Poison Pill’ when it is used well, becomes a restorative strategy, but when it is abused, it can become a poisonous drug. The ‘Poison Pill’ strategy protects existing management. It limits new stockholders entrance into the company, existing stockholders can miss opportunities to sell their stocks at maximum prices, and major stockholders may find it hard to replace existing management with better management. Finally, “if this is abused, economic vitality can be lowered and property rights of minority shareholders can be potentially invaded,” said Professor Lee.

Another method to avoid hostile takeovers is the ‘Golden Parachute’ strategy. A company that is a target of a hostile takeover can raise the costs associated with the takeover through this clause. Then, the M&A company which would like to take over a company gives up its M&A plans, because of the M&A costs have increased. Companies include this clause in their articles of incorporation as a defense against any future hostile M&A.

Most developed countries enforce some foreign investment regulation for the protection of key domestic industries. For example, Japan made laws so that the government can make a judgment by foreign investment, and can limit investment approval, because of its influence on national security, public order, air safety and national economy. Other countries like England and France have a Golden Stock strategy for important national industries and protect them. When a foreign company tries to takeover an important national industry like steel, energy, or other, the government can exercise the power of a stockholder to veto the takeover.

The Exon - Florio law and strategies like the ‘Poison Pill’ are necessary to protect the rights of management in key industries. Because of hostile M&A, companies cannot work well to defend management’s rights. It is essential to prevent corporate spying within domestic high technology industries. Hi-tech private enterprises that develop independently are harder to protect from spying through M&A. However, the OECD agreement Article 2 ‘Code Liberalization of Capital’, says that member nations are allowed to place limits against foreign investment.

However, this is an act from a global standard. There is an alternative opinion that opposes this policy since that can cause moral and financial risk for the majority shareholder. While an M&A hostile takeover is being arranged with a governmental M&A representatives, this can cause moral hazard of the majority stockholders, since they will be restricted from buying and selling stock.

Because of the globalization of financial markets, foreign investment has become an essential and indispensable element for economic improvement. The right roles of M&A cannot be neglected, either. There are many possibilities for the foreign speculators. No matter how much is at stake for the majority stockholders, key companies like iron and steel, information technology (IT) a legal device to defend the hostile M&A against key industries is necessary.