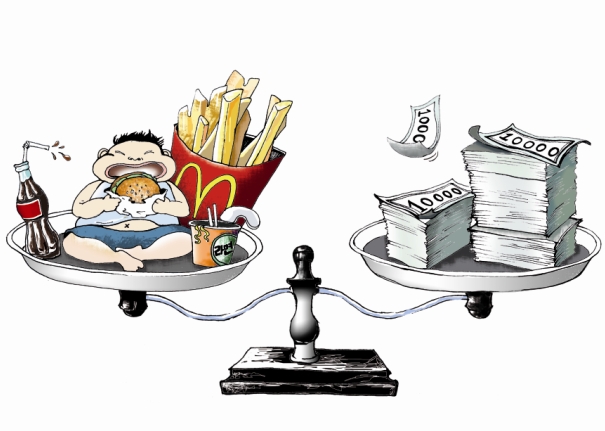

Super Size Me, a documentary film made by Morgan Spurlock, shows the audience how fast- food can affect a person. Spurlock starred himself in the movie and participated in an experiment in which he ate only hamburgers for one month and observed the changes in his body. He ended up gaining 11 kilograms, became lethargic, and also suffered from depression. The reason that Spurlock put up with this kind of painful experiment, was to bring attention to the increasing spread of obesity throughout U.S. society. All over the world, as much as 300 million people are suffering from obesity, and about 1 billion people are estimated to be overweight. This is definitely a serious problem, and Europe is currently confronting this issue by issuing a fat tax.

What is a fat tax?

A fat tax is a concept that was first introduced by Denmark. An additional 16 krone (roughly 3400 won) per kilogram of saturated fat is imposed on products that have more than 2.3% of fatty acids in it. This system was designed by the Denmark government in order to decrease the intake of greasy foods. Denmark had already imposed taxes on products such as candy, carbonated drinks and other junk food since 90 years ago. However it wasn’t until recently that they also started to impose a tax on products that contain a certain amount of fat. According to a research team at North Carolina University, imposing about an 18% tax on products such as pizza or carbonated drinks really could bring the result of decreasing the intake of calories. Of course taxes won’t be able to prevent obesity completely, but results show that it could decrease the average adult’s weight by 2 kilograms.

Traditionally, French people have a rather slim figure, but currently obesity is a serious problem with the overweight population currently having exceeded 20 million people. In response to this issue, France has also chosen to impose a tax of about 1% on carbonated beverages. Due to this sort of tax, the price of drinks such as Coca-Cola or Fanta will be increased by 3~6 euros (47~95 won) per liter. The French government is expected to collect about 1 hundred million pounds (roughly 180 billion won). In the near future, their government will also apply fat taxes to the tomato ketchup and salt that are used in school cafeterias. Most schools probably won’t buy the rather expensive ingredients that a fat tax has been imposed upon, and the health of students will also be better off without fatty or salty ingredients. School meals have a great impact on children’s health, so problems of child obesity could be improved by imposing fat taxes on certain ingredients that are delivered to schools.

Should the Korean Ministry try it out?

Due to various westernized menus, the obese population in South Korea is also increasing, and there is much debate as to whether we should adopt the fat tax system as well. Regarding this issue, the Ministry of Strategy and Finance are considering it, but are very hesitant to do so. According to the Ministry, though the obese population may be increasing, it is still relatively low compared to other Western nations, which is why they do not feel the need to rush for such a tax. A fat tax could also decrease the purchasing power of low-income groups and could cause inflation. The Ministry believes that a tailored system for each gender and age range is needed to deal with obesity rather than forcing people to pay up. It is definitely true that a systematic method is needed in order to treat patients struggling with obesity. However, according to a report written by an the Korean Insurance Research Institute, the social costs that were caused by sicknesses that come with obesity such as diabetes, high blood pressure, stroke, heart disease added up to 1 trillion 8 hundred billion won in the year 2008 alone. The report points out that this is a big financial burden and could lead to a serious budget deficit of 50 trillion won by 2030. When looking at such statistics, it doesn’t seem like such a bad idea to introduce a fat tax, which could prevent some people from becoming obese, rather than treating them after they have become sick. South Korea especially has a wide variety of crackers, ice-creams and ramen, so there are plenty of products that could be eligible to impose a fat tax upon.

In Denmark, there was already a problem with panic buying, in which excessive amounts of products were bought before the fat tax was imposed. This phenomenon could very much happen in South Korea if such a tax system is brought in, but it is a temporary happening and should be coped with, if the fat tax is to be enforced effectively. The bigger problem though, is that most of the obese population belongs to the poorer classes of society. Healthy products such as vegetables or fruits are too expensive to buy for those with a low income, which leads them to buy foods that are cheap and high in calorie but unhealthy. It is because of this reason that analysts keep pointing out the fat tax will only put a burden on the low income class.

What people can do for the low-income class

In regards to the concern that people with lower incomes are usually the ones consuming products which are eligible for the fat tax, the finances secured from collecting the tax could be used to subsidize purchasing groceries for those people. Even so, there needs to be a more long term solution, and an appropriate example can be found through an organization called People’s Grocery in the US. This group was started by a few young people who got together in the slums of San Francisco. These people borrowed some land from the city, cultivated some organic plants, and started supplying them to the local residents. They were able to do so by regularly opening a vegetable shop in the streets and selling their products at a price much lower than the market level. Not only did they do this, but they also hosted free food tasting events for the purpose of improving children’s eating habits, as well as organic vegetable cooking classes for the parents. As a result, the locals, who had only known junk food, instant meals, candy, and alcohol, started to buy fresh vegetables, which were put on the dinner table, directly leading to health improvements. This sort of program could definitely be applicable to South Korea. The government could offer some funding in order to borrow some farming land. Then, the organic crops could be sold at a very low price or offered for free for those who receive a supplementary living allowance, and profits could be covered by selling the products to ordinary customers at the normal market price.

Obesity is a worldwide problem that many countries are struggling to solve. The fat tax being practiced in other nations is definitely a concept that is worth being considered in South Korea also. Of course there is much reason for the government to feel that it is not the right time for us to push through with this sort of tax and it is true that the system needs to be adjusted to the specific conditions of South Korea. Even so, when imposed while implementing the solutions mentioned above, a fat tax could actually be the first step in tackling obesity in our country as well.