A real estate magnate worth 10 billion won showed up on a TV show in 2013. The villa[1] construction project which made him rich started from a small piece of land and was turned into 48 houses in the old urban center of Seoul. The show crowned him the "Villa King," but only three years later was he dethroned by the members of his internet cafe for misappropriating their deposited investment, eventually being arrested in court for fraud. Ever since then the term "villa king" referred to villa fraudsters. Since 2022, villa kings came to the fore one after another after their deaths, and their tenants mostly in their 20s and 30s could not get their jeonse[2] deposits back.

The Three Villa Kings, Dead One After Another

There have been three notable cases in recent years which have made the news, all of which only came to light after the landlord passed away. Most of their properties were in Gangseo-gu and Yangcheon-gu, Seoul, and Michuhol-gu, Incheon. Though the “guarantee for a refund of jeonse deposit[3]” (deposit refund guarantee) by Housing & Urban Guarantee Corporation (HUG) or Seoul Guarantee Insurance (SGI) exists to protect tenants, this does not help in cases where the landlord is dead. Compare the cases below:

|

|

Mr. Jeong (~21/7) |

Mr. Kim (~22/10) |

Ms. Song (~22/12) |

|

Properties (villas and officetels[4]) owned |

240 |

1139 |

58 |

|

number of deposits guaranteed with HUG or SGI |

Less than 24 |

440 |

46 |

|

Total in damages |

17 billion won |

81.5 billion won |

5.7 billion won |

The Conspiracy of Villa King-makers and their Heyday of High Jeonse Deposits

How could these Villa kings (and queen) possibly buy all those houses? And where did all those deposits disappear to? In fact, the role of the villa king was merely providing their name as a landlord. Most of the villa kings were incapable of repaying jeonse deposits in the first place. Let’s take a look at how the villa kings were made.

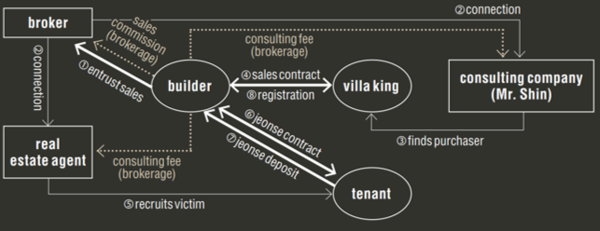

The fraudster sets the lease price of a nw villa above the sale price suggested by the builder, and receives a deposit from a tenant. Then the fraudster buys the villa from the builder with their tenant’s deposit, taking the margin between the deposit and the sale price as their own. Now the fraudster has a house and even some money, without having spent even a single penny of their own. For the "empty lease” which the tenants cannot get their deposits back, the fraudster replaces their name as the landlord with the villa king’s and conceals their whereabouts. Even worse, the dead villa king’s tenants who hold an empty lease cannot even proceed with an investigation because the right of arraignment disappears with the villa king’s death. Meanwhile, there were even cases where the villa king somehow ‘signed’ a lease contract three days after their death, or that the dead villa kings, who had nothing to do with each other, somehow divided up five buildings, or processed their transactions on the same date as the balance date. Suspicions were raised that there were forces behind those villa kings who systematically manipulated lease prices. And it became a fixed fact with the arrest of Mr. Shin, a CEO of a real estate consulting company, and 78 others in January. Shin conspired with other villa kings, including another villa king Mr. Kim (50) who was arrested in December, and the villa king Mr. Jeong, to buy 628 houses in Gangseo-gu and Yangcheon-gu of Seoul, and Incheon. There were 37 confirmed victims alone, and the deposits they did not get back amounted to 8 billion won combined. In particular, Shin committed an organized fraud by splitting the roles from searching for villas to recruiting victims, along with the arrested distributors and licensed real estate agents. In the process, Shin and several real estate consultants and brokers received from millions ~ ten million won per case for brokerage. 800 million won of the brokerage was provided by villa builders. Among them, only 100,000 won to 500,000 won was Mr. Jeong’s claim.

There were several enabling factors of such jeonse fraud methods. First of all, lease prices soared due to the real estate boom in 2021 to 2022. In addition, the Housing Lease Protection Act, which includes the ceiling on monthly rent[5], and the right to request contract renewal[6] was enforced since 2020. As a result, the ratio of lease prices to sales price (lease price rate) exceeded 80% in many regions. The generally high jeonse prices made the perfect environment to receive higher rents in new villas and multi-family households. In most cases where the landlord refuses to return the deposit when the tenant is subscribing to the deposit refund guarantee, HUG or SGI pays the deposit for cover and claims the landlord the right to indemnity under condition that the tenant gives notice of the termination of the lease contract. However, if the landlord, who failed to pay billions of won in comprehensive real estate taxes dies and they have no legal heir, the tenant has no legal target to notify of the termination, so the deposit payment will be suspended indefinitely. Tenants who do not subscribe to the deposit refund guarantee are likely to get their deposits back through the auction process of the house, but even if they are auctioned off, tax arrears are the top priority, and if there is a bank loan, the bank's mortgage makes the tenants last in priority. As such, the several incidents of villa kings revealed the structural problems in Korea’s jeonse system.

Young, Inexperienced People Are the Prey

According to the Ministry of Land, Infrastructure and Transport, more than half of the victims involved in 106 transactions suspected of jeonse fraud between late September and November 2022 were in their 20s (17.9%) and 30s (50.9%). The reason is that first, villas and officetels do not provide market prices at market research institutes. Therefore young members of the society or tenants who just moved into the region have difficulty in determining the fair market price. Fraud groups made use of this point to introduce the house as if the lease price was fair, and then took profits from the margin of the jeonse price and sale price.

The second reason is the vulnerable point in the loan system. Some of the victims of the villa king said, "If I could not get the loan, I wouldn't have signed a lease contract [in the first place].” A, a victim of villa king Mr. Kim, was deceived into a jeonse fraud by a real estate agent introducing a neighborhood commercial facility as a house. A was introduced to the illegal loft house by a licensed real estate agent, and the loan counselor he connected filled out false documents by disguising the neighborhood commercial facility as a house. A took out a loan with this false document and paid his jeonse deposit, but could not get it back after the contract expired. Moreover, as the building was verified as a loft house, it became impossible to extend the lease loan. Since villas are cheaper than apartments in the city center, many people take out loans to sign lease contracts like A. Experts pointed out that while the current loan system sets the credit line too high, there is a lack of safety measures against risk. If one uses loans from the bank or HUG, the person can borrow up to 80% of the deposit, and newlyweds and young households who meet certain standards can borrow up to 90% of the deposit.

Measures to Prevent Jeonse Fraud

The fundamental problem of jeonse frauds lies in the jeonse system itself, which makes it possible to use the deposit as a private financial instrument without credit or security. Hence, in September 2021, lawmaker Kim Sang-hoon proposed the “Bad Lessor Disclosure Act” (Amendment to the Housing and Urban Fund Act). It is a bill that discloses the personal information of malicious landlords who neglected to repay the lease payments paid by HUG. The amendment requires HUG to disclose the names if HUG paid the deposit by proxy due to non-return of the lessor or if they have received compulsory execution/preservation measures more than twice over the past three years. Currently, the Credit Information Use And Protection Act prohibits arbitrary disclosure of the blacklist of malicious renter, so the bill has been delayed by the National Assembly for more than 15 months.

The good news is that the amendment to the Framework Act on National Taxes and the amendment to the National/Local Tax Collection Act will go into effect in April, cross the threshold of the National Assembly. The former aims to repay the tenant's deposit first if the legal date of the relevant tax (tax imposed on the property itself), such as comprehensive real estate tax, is after the tenant's fixed date when forced collection procedures such as auctions and public sales, are in progress. The latter allows tenants who have signed a lease contract to access the landlord's national tax arrears without the landlord's consent. However, the amendment is nominal to tenants in that it can only be confirmed after signing a lease contract, which will not protect those from falling into the trap in the first place.

Of the 1,500 victims of jeonse fraud, some put their entire property, and others even owed money to the bank for their dreams. However, the responses that came back were the vain news that they could not get back the deposit, and the nonsense that they had to find the landlord's heir to get it back. According to HUG's data on "intensive management multiple home debtors[7]," as of November 2022, the number of jeonse accidents by the top 30 on the list combined reached 3,459, and the amount of losses of their victims reached 725 billion won. The government should provide proper compensation for their loss as soon as possible and prevent the emergence of future villa kings.

[1] In Korea, the term “villa” refers to apartment or flat

[2] “Jeonse” is a housing lease system unique to Korea. The tenant pays a lump-sum deposit to the landlord, and receives the whole deposit back when the contract period (mostly 2 years) expires. The deposit typically ranges between 70 to 90 percent of the unit's sale price.

[3] It guarantees the return of jeonse deposit to lessee upon termination of jeonse lease agreement.

[4] Dual-purpose buildings used for commercial and residential purpose

[5] The law limits the increase in rent to less than 5% of the previous contract when renewing, in order to protect tenants from unilateral increase in rent prices by landlords

[6] the system guarantees tenants to live for another two years by renewing the contract after two years of residence by rent

[7] Malicious renters who have been out of touch, or have not paid back any guaranteed debts over the past year, among the cases in which HUG has paid back the jeonse deposits more than three times