On February 1st, the Federal Open Market Committee (FOMC) announced that it has raised its key federal funds rate by 0.25%, in order to keep putting downward pressure on economic growth in its bid to slow inflation. It was the smallest rate hike since the Federal Reserve began its aggressive campaign. Last year, the rate hike rose by 0.75% four times in a row to suppress inflation and slowed down to a 0.5% increase by December. It took the traditional “baby step” this time. In other words, the raise in key interest rates, which was carried out to ease the most severe inflation in four decades, has returned to its normal speed. This refers to a signal that the worst has passed, considering that the increase in the Consumer Price Index (CPI) in the United States in December slightly subsided at 6.5%. In financial markets, there are widespread observations that monetary policy will be more accommodative than last year and that the federal funds rate hike will stop soon. However, the FOMC finds it difficult to effectively contain inflation because wage growth, labor market demand, and the service inflation rate are still high. The conflict between investors’ hopes and the FOMC’s policy and its ultimate solution are emerging as the biggest question marks in the financial markets in 2023. Let's take a look at the course of inflation that shook the world, the impact of the US’s disinflationary signal on the market and economic policy, and predict the world economic trends in 2023.

1. Process of the Global Inflation

The ultimate cause of inflation is a lack of supply compared to demand. Supply shortages have been impacted by rapid climate change, pandemic-induced supply disruptions, labor shortages, production disruptions, and port bottlenecks. Food and energy shortages caused by Russia’s invasion of Ukraine further worsened the situation. Moreover, crop damage due to the largest megadrought in 1,200 years in the central and western regions of the United States was severe. The world’s four major breadbaskets outside the US were also strongly affected by climate change. Argentina, which exports wheat and soybeans to more than 80 countries around the world, had only 50% of their average rainfall last year. Russia’s Invasion of Ukraine also caused food shortages in some poor countries and caused wheat prices hit an all-time high as these two countries that supply a quarter of the world's wheat. Moves by the Organization of Petroleum Exporting Countries (OPEC) to limit supply also put pressure on oil prices. In 2021, many crude oil refinery facilities in the Gulf of Mexico were destroyed by the powerful hurricane 'Ida' that hit the southern United States, and about 20% of all crude oil production facilities in the US were hit hard. Under these circumstances, international oil prices rose sharply due to power shortages in China. In addition, oil prices soared as problems such as Russia’s gas supply cutoff and Russia’s invasion of Ukraine occurred. US President Joe Biden visited Saudi Arabia to request an increase in crude oil production. However, due to rapid changes in the international situation and problems in the historical relationship between the two countries, Biden came back from Saudi Arabia empty-handed. As such, rising prices of food, energy, and gasoline have increased inflation around the world. In addition, the financial investment of each country needed to recover from the COVID-19 pandemic over the past three years has created a bubble in asset values and caused inflation. In the end, central banks around the world started raising interest rates to control soaring inflation. Meanwhile, inflation began to show signs of slowing in October last year.

2. Inflation Began to Slow Down

a. The US’ Inflation Is Cooling Down

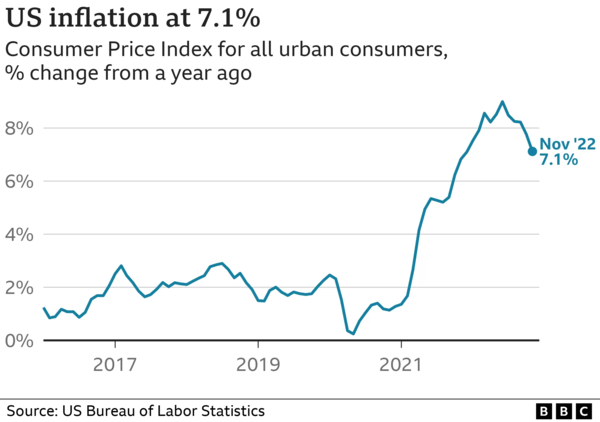

“Inflation has eased somewhat,” Federal Reserve Chairman Jerome Powell said at the most recent meeting. As the US inflation rate slowed, there was an optimistic prospect that the US economy would reach a “Goldilocks” state, meaning an ideal economic situation, as well as a gradual contraction. In January, the U.S. Department of Labor reported that the CPI of last December rose 6.5% compared to the previous year. It can be seen that it has slowed down significantly compared to 7.1% in November. After peaking at over 9% in June last year, the rate of increase fell for six consecutive months, recording its lowest level in 14 months. The recent slowdown in inflation can be attributed to the decline in energy prices and the increasing rate of food prices. In particular, gasoline prices, which fell by 9.4% compared to the previous month, significantly slowed inflation. The market also noted that the CPI in December fell 0.1% compared to November. It is the first time since May 2020 that the CPI has fallen. Regarding this, President Biden praised the success of the policy in a speech at the White House, emphasizing that “It all adds up to a real break for consumers, real breathing room for families, and more proof that my economic plan is working.” However, Forbes emphasized that "when looking at the details, signs of inflation easing should not be taken too seriously." Actual food prices rose 6.2% year-on-year in November, and housing costs rose nearly 7.5%. Service prices are also increasing, rising from 6.8% in November last year to 7.0% in December. In other words, inflationary pressure still exists, and we must not be negligent, such as easing policies, despite the signs of slowing inflation.

b. Global Inflation Pulling Back

In November 2022, the Financial Times (FT) reported that global inflation had peaked and was expected to ease gradually over the next few months. The FT said that major indicators related to consumer prices, such as factory prices, marine carriage charges, raw material prices, and expected inflation, are all trending downward. It further mentioned that consumer prices are likely to fall even more as price pressure on the supply chain eases. Capital Economics, an economic analysis agency, also confirmed that inflation in developing countries such as Brazil, Thailand, and Chile is already falling, and that price pressure is also decreasing in some developed countries. Inflation in Europe fell to single figures for the first time since August. In January, Eurostat, the EU's statistical agency, reported that the Eurozone's CPI for December rose 9.2% year-on-year. The inflation, which peaked due to the influence of the international situation, including COVID-19, is now on the decline. The market is looking at this phenomenon optimistically, but on the other hand, there are also voices raising concerns. So, let's look specifically at the world's reaction to slowing inflation.

3. Overall Reaction

a. Reactions of the Markets

When the FOMC acknowledged that inflation was slowing, the market cheered loudly. This is because the market expected that the stance of high-intensity tightening and interest rate hikes, which have continued so far, will be somewhat eased. The Wall Street Journal noted that “Investors are betting the Federal Reserve (Fed) will cut interest rates as early as the second half of the year” and “Evidence that inflation is pulling back has fueled bets.” In the financial markets, there are widespread observations that monetary policy will be more accommodative than last year and that the federal funds rate hike will stop soon. Some predict that interest rates may go down within this year. The Chicago Mercantile Exchange (CME) Group said that the Interest Rate Derivatives market traders see a 90% chance that the Fed will raise rates two more times by March this year, to about 4.9%. It then predicted a 60% chance of cutting rates at least once by December. Despite fears of a recession, these expectations led to a 3% increase in the Dow Jones Industrial Average, 6% in the S&P 500, and 11% in the Nasdaq in January. As such, the market tends to focus on Chairman Powell’s remarks on “disinflation.” After the February rate decision meeting, FMOC Chairman Jerome Powell stated the word “disinflation” 15 times in a 45-minute conference. However, economists’ opinions contrast with the optimistic market expectations. Reese Williams, chief strategist at Spouting Rock Asset Management, pointed out that “I think inflation is coming down, but we won’t get to the Fed’s 2% target until this summer.”

b. Opinion of the FOMC

Contrary to investors’ expectations, the FOMC insists it is too early to think about cutting rates this year. The Fed’s Chairman Powell said that while it was true that inflation was easing in some areas of the market, it would be "premature" to declare a full Fed victory. He added that “we are talking about a couple of more rate hikes [...] because inflation is still running very hot.” He stressed that the economy is still in the “early stage” of easing inflation. Some Fed members directly pointed out the optimistic market reaction to inflation. Last December, Mary Daly, president of the Federal Reserve Bank of San Francisco said, “To be honest with you, I don’t quite know why markets are so optimistic about inflation,” after a Fed meeting on February 2nd.

A period of disinflation has begun. Markets are excited, and the FOMC is wary. This is because capital can flow into the market just by the market’s growing expectations. The market's attention is focused on the FOMC's federal funds rate decision, which determines the world's interest rate policy. There are plenty of past examples of hasty cuts in interest rates that led to the wrong outcome. 50 years ago, when interest rates were raised and lowered repeatedly, the Great Inflation blew, and Japan's “the lost decade”, which occurred when the government raised interest rates excessively to burst the bubble created by the low interest rate. There is significant precedent of making the wrong choice by being deceived by the hopeful disinflation march. The time has come for the international community to make prudent decisions not to repeat the mistakes of the past.