The national pension, one of the social insurance programs in Korea, is operated by a paycheck deduction that people pay the government each month until their retirements. Then, the Korean government guarantees a constant income after the retirement by paying back the pension. However, the pension is at a risk of financial collapse due to the changes in the population structure such as an aging population and low birth rate, although the national pension seems to be a useful system. Nevertheless, there was no decent improvement of the national pension in Korea except lowering income replacement ratio[1] in 2007. Finally, many people have expressed their concerns about not able to get the national pension after 2055. Is the national pension really at risk?

What Is the National Pension?

In 1972, the Park Chung-hee regime tried to legally introduce the national pension for the first time. The original purpose was gathering funds for economic development, not guaranteeing for the public’s later years. However, the attempt for the national pension failed as Korea faced an economic crisis due to the global oil crisis. Then, Chun Doo-hwan, asserting a democratic welfare state, introduced the national pension after many advisers’ persuasion in 1986. The national pension was launched for employees of workplaces with more than 10 people in 1988, and the pension’s range gradually expanded to workplaces with more than 5 in 1992, and more than 1 in 2006. According to the National Pension Service (NPS), the national pension is one of the methods to resolve the situation of severe elderly poverty under the increasing number of the nuclear familes and aged population. Also, the national pension attracted controversy with deferred payment in 2020. The participation period (the period when people have to pay for the national pension) is recognized when insured persons additionally pay pension premiums corresponding to amount during the period failed to pay, after applying exceptions to payment. It is useful for people with irregular income to increase their expected pension by fulfilling a minimum payment period and expanding the participation period. However, this system became problematic since financially stable people, additionally paid large amounts and increased their pension at 60 (upper limits for insuring) as their investment techniques.

Problems of the National Pension

Concerns about Being Exhausted

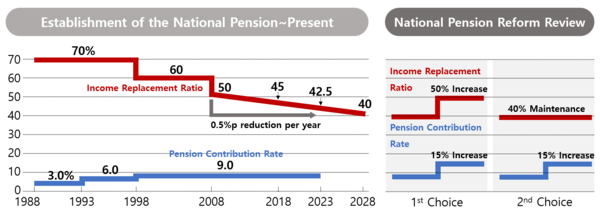

Hankyoreh explained the government’s calculations about the national pension this January. Specifically, it said that the pension would be exhausted by 2055[2] as the national pension goes into the red in 2041, when the situation remains the same: the pension contribution rate freezes at 9%, and the income replacement ration is set for 42.5% to 2028. This calculation appears since the expectation time for exhaustion advanced due to rapid speed of the current aging and low birth rate. It is hard to have much hope about the growth of the birth rate since the expected birth rate of Korea for this year is 0.73, and the rate should be at least 2.10 to maintain Korea’s population scale, although the birth rate may increase when people born in 1991~1996 enter their thirties. Moreover, economic slowdown is one of the factors moving up the exhaustion time.

With the previous estimation, the average annual economic growth rate of Korea was predicted to average 1.1% compared with the previous year from 2023 to 2093. However, this year, the Korea Development Institute showed that the economy is on slowdown to the rate of 0.7% for the same period. It seems that the premium income’s prospect is more negative as decline of the economic growth rate affects to the diminution of rise in wage of insured persons. According to the previous estimation, the average amount of nominal wage growth from 2023 to 2093 was 1.9%, but the average declined to 1.7% with estimation of this year. In addition, some showed concerns that approximately 30% of the public’s salary will go to the national pension starting in 2026. According to the Hankyoreh’s January article, the pension contribution rate of future generation can be positioned under 30% as delaying the time of exhaustion by increasing the current generation’s pension contribution rate or raising the age when people can first receive their pension. Also, the pension contribution rate can be lowered from adding more insured persons by extending of the retirement age to expand the total amount of insurance fee from the insured.

Low Rate of Profit

According to the Chosun Ilbo in February, the national pension’s rate of profit for the past 10 years was about annually 4.9%, which is quite low, compared to the 5.3%, figure of Japanese public pension that is mainly operated through bonds. Many people long expressed concerns that the national pension would be exhausted, or the rate of profit would record minus figures. The reason of this low rate is the domestic bond with high stability that makes up the largest portion among the financial assets that NPS invests. Even though overseas stocks account for the second largest portion, the rate of profit cannot be constant since the overseas stocks are affected by global situations such as U.S.-China trade conflicts. In other words, the national pension has had limited rate of profit since the pension has invested in mainly stable assets.

Reactions of the Korean Government and the Relevant Organizations

Accordingly, many people are worrying that they will not be able to get their pension if it becomes exhausted. However, the NPS, and the Ministry of Health and Welfare (MOHW) responded that those concerns never turn out to be reality since the national pension is one of the social insurance programs operated by the Korean government. Moreover, they added that they would discharge their duty to provide the pension with national finances, even if the pension is all consumed. They added that they are going find ways to stipulate the state’s responsibility to guarantee the pension that Article 3-2 of National Pension Act specifies. Besides, since the Korean government only use 1.7% of GDP for the national pension, while the European states use more than 10%, the NPS and the MOHW can provide the pension by expending about 9.4% of GDP by 2080 when the government’s support and income of the insured persons increase.

Furthermore, a civilian advisory board under the special committee for national pension reform in the National Assembly, (civilian advisory board)[3] discussed based on the finance forecasting to draw up the reform draft for the national pension this January. Nevertheless, they failed to come to an agreement, since there were two conflicting opinions: One argued the need to make financial stability of the national pension, and the other argued the need to guarantee a reasonable income in the public’s later years. People who prioritized financial stability, proposed to relieve imbalance of earnings and expenses by increasing the pension contribution rate, considering the national pension’s structure, and low contribution-high benefit. Specifically, they suggested to raise the contribution rate from 9% to 15%, while keeping the income replacement ratio the same. On the contrary, people who prioritized the reasonable income during the later years, believe that the state can utilize taxes as well as insurance fee, and profits of the NPS for the national pension. Thus, they want to elevate the income replacement ratio to 50%, arguing that the government’s finances are enough as only a few percent of GDP is currently expended for the national pension. Finally, they failed to make consultation as some lawmakers rejected to raise the pension contribution rate, although there was an alternative proposing 45% of the income replacement ratio, increasing the contrition rate 15%.

According to Asia Business Daily in February, the discussion is progressing to conclude for getting less pension, and increasing the insurance rate due to the atmosphere where people think raising the insurance rate is positive, but raising the income replacement ratio is negative. Regardless of this discussion, the MOHW should submit a comprehensive plan for the national pension after approval of the president by this October.

Reactions and Criticism of the Public, and Other Raised Solutions

The public’s reactions for the reforms of the national pension are mostly negative. Also, an anonymous netizen expressed his or her complaint that 59 years old people find it hard to keep a job, and added that there is no workplace allowing people to work until 64 years old. Another netizen proposed an alternative lowering the pension to 80% after 75 or 80 years old, rather than delaying the minimum age to get the pension. In February, the News Theone reported that the public is showing dissatisfaction since the government has made itself unreliable by presenting policies without consistency. Then, there is a forecast that social agreement can be difficult, as this public’s dissatisfaction cause the conflicts between generations. Some economic newspapers raise their voices insisting the need to reinforce the private pension to solve this problem. The Maeil Business News Korea published an article saying that, “we will consider plans to expand the private pension according as reform of the national pension.” However, Professor Sophia Seungyoon Lee from the School of Social Welfare, Chung-Ang University, worried about inequality between people able to afford private pension and those unable to.

The special committee for national pension reform in the National Assembly (the special committee) made its position clear by saying that it will discuss reforming the pension contribution rate, and income replacement ratio after announcing the Korean government’s reform plan this October. Then, Kang Giyun (Kang) of the special committee explained that they can proceed with the reform after the pension’s structures have improvements. According to the Korea Economic Daily in February, it seems that Kang meant the care system of income for seniors through a connection of a retirement pension, a basic pension, and the national pension. However, a special committee would be unable to avoid the criticism about evading the pension’s problem by turning the discussion that the civilian advisory board debated since last November due to the public’s reactions about changing the pension contribution rate.

Professor Jeong Seeun from the Department of Economics of Chungnam National University said, ”It is important to make creative solutions for the population problems by extending the working period and delaying the retirement age so that the generations can live together, not focusing on the only exhaustion time of the national pension.” Thus, the Korean government and relevant experts should draw up the reform plan for the national pension while considering the future circumstances, and ultimate problems such as low birth rate, and rapidly aging population.

[1] The income replacement ratio determines how much one will receive once they pay for their pension, based on their average income while working.

[2] In 2055, people born in 1990 will become 65 years old, and they should begin to receive their pension.

[3] The special committee for national pension reform in the National Assembly consists of 13 lawmakers of the ruling and opposition parties, and the civilian advisory board consists of 16 experts about the pension.